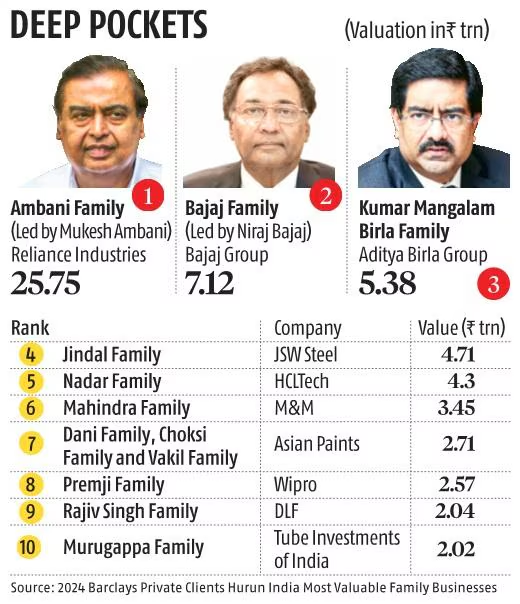

The Ambani family has claimed the top spot in the first-ever Barclays-Hurun India list of the most valuable family businesses, with a staggering valuation of ₹25.75 trillion. This impressive figure is nearly equivalent to one-tenth of India’s Gross Domestic Product (GDP). The Ambani family’s vast business empire, primarily driven by Reliance Industries, encompasses sectors like energy, retail, and telecommunications.

Methodology- Ambani family

The rankings, based on company valuations as of March 20, 2024, exclude private investments and liquid assets. Cross-holdings are adjusted to prevent double counting, ensuring an accurate representation of each family’s business value. The Ambani family’s wealth valuation includes their shares in Reliance Industries, Jio Platforms, and Reliance Retail, among others.

Top Family Businesses

- Ambani Family

- Valuation: ₹25.75 trillion

- Sectors: Energy, Retail, Telecom

- Key Companies: Reliance Industries, Jio Platforms, Reliance Retail

- Bajaj Family

- Valuation: ₹7.13 trillion

- Leader: Niraj Bajaj

- Sectors: Automobile

- Key Companies: Bajaj Auto, Bajaj Finserv

- Birla Family

- Valuation: ₹5.39 trillion

- Leader: Kumar Mangalam Birla

- Sectors: Metals, Mining, Cement, Financial Services

- Key Companies: Aditya Birla Group

The top three family businesses together have interests valued at $460 billion, equivalent to the GDP of Singapore, according to the report.

Additional Notable Families

- Sajjan Jindal Family

- Valuation: ₹4.71 trillion

- Rank: Fourth

- Nadar Family

- Valuation: ₹4.30 trillion

- Rank: Fifth

- Notable: Roshni Nadar Malhotra is the only woman in the top 10 family businesses.

First-Generation Family Businesses

Although the list focuses on multi-generational family businesses, the Adani family, established by Gautam Adani, is recognized as the most valuable first-generation family business with a valuation of ₹15.44 trillion. Other prominent first-generation businesses include:

- Poonawalla Family

- Valuation: ₹2.37 trillion

- Sector: Pharmaceuticals (Serum Institute of India)

- Divi Family

- Valuation: ₹91,200 crore

- Sector: Pharmaceuticals

Industry Contributions

According to Anas Rahman Junaid, founder and chief researcher at Hurun India, the industrial products sector, with 28 companies valued at ₹458,700 crore, plays a vital role in enhancing India’s global competitiveness. Additionally, the automobile sector (23 companies valued at ₹1,876,200 crore) and the pharmaceuticals sector (22 companies valued at ₹788,500 crore) are pivotal in maintaining and advancing long-term economic stability and growth in India.

Financial Trends

Nitin Singh, head of Barclays Private Bank, Asia Pacific, noted a significant trend of deleveraging among family-run businesses, resulting in stronger balance sheets. The focus has shifted towards opportunities within India, with large businesses and families concentrating on contributing to the Indian economy.

Most Valuable Unlisted Company

Haldiram Snacks, valued at ₹63,000 crore, holds the title of India’s most valuable unlisted company. The company recently attracted attention when US-based private equity firm Blackstone made a non-binding offer to acquire it. However, the transaction is delayed due to the current promoters seeking a higher valuation.

Real Estate Family Businesses

In the real estate sector, DLF Ltd. and Macrotech Developers were identified as the most valuable family businesses:

- DLF Ltd.

- Valuation: ₹2,04,500 crore

- Macrotech Developers

- Valuation: ₹1,12,200 crore

These findings highlight the resilience and adaptability of multi-generational family businesses in navigating India’s complex economic environment. By leveraging their deep understanding of the market, these families continue to thrive and contribute significantly to the country’s economic landscape.