Broadcom’s valuation skyrocketed to $1 trillion as its shares surged 21% on Friday, driven by CEO Hock Tan’s bold forecast of a $60-$90 billion AI revenue opportunity by 2027. The company’s optimistic projections signal its intent to dominate the burgeoning AI chip market

Contents

Key Highlights

- Massive AI Growth Opportunity:

- Broadcom estimates the AI chip market will expand to $15-$20 billion in fiscal 2024, with a projected leap to $60-$90 billion by 2027.

- The company expects to secure up to $50 billion in AI-related revenue by 2027, assuming a 70% market share based on its 2024 performance.

- Market Reaction:

- Broadcom shares surged 21%, propelling its valuation past the $1 trillion mark.

- Rival chipmakers experienced mixed responses:

- Marvell: Up nearly 9%.

- Nvidia and AMD: Dropped by 3%.

- TSMC: Rose by 4%.

- Hyperscaler Success:

- Broadcom secured two major hyperscaler customers in 2024, driving $12.2 billion in AI revenue.

- Notable partnerships with cloud giants like Microsoft and Alphabet have been instrumental.

Challenges and Analyst Perspectives

- Skepticism Over Projections:

- Analysts like TD Cowen labeled the forecasts as “difficult to prove/disprove.”

- Rosenblatt Securities predicts Broadcom’s 2027 market share could fall between 20%-50%, significantly lower than its 2024 estimate.

- Competitive Landscape:

- Nvidia remains a formidable rival, with investors eyeing a shift from AI model training to inference, where Broadcom may gain ground.

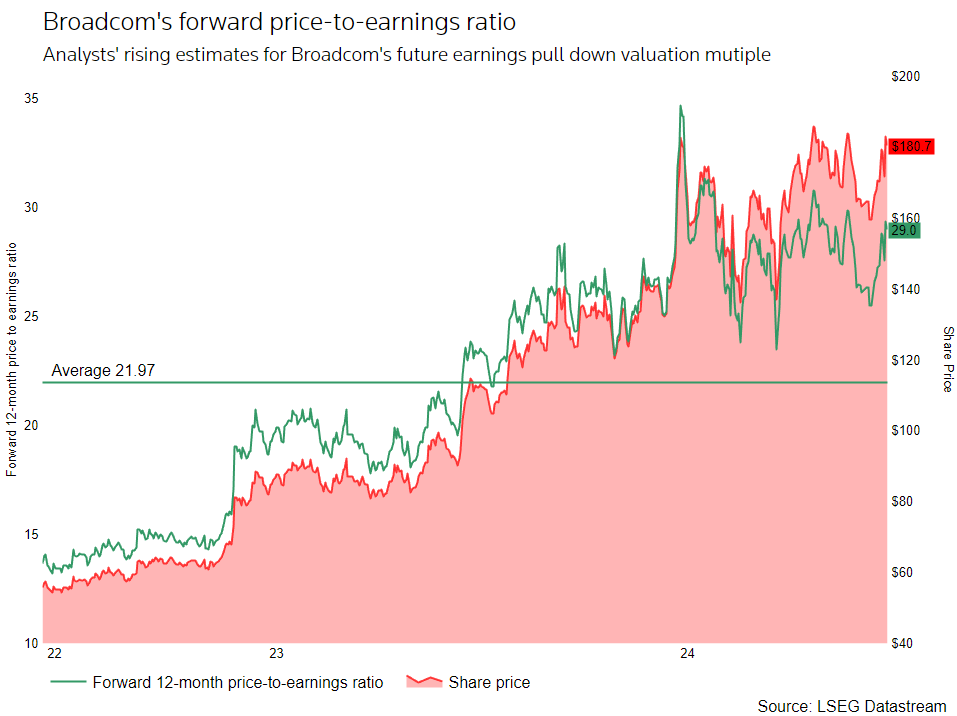

- Broadcom’s relatively lower price-to-earnings ratio (29.8 vs. Nvidia’s 31.03) makes it an attractive investment.

Investor Sentiment– Broadcom

- Broadcom’s bold AI narrative and its strategic positioning have fueled optimism.

- “They’ve given investors a reason to dream,” noted Bernstein analyst Stacy Rasgon, humorously suggesting Hock Tan consider emulating Nvidia CEO Jensen Huang’s iconic leather jacket style as a symbol of AI leadership.

Broader Implications

Broadcom’s rise underscores the growing demand for AI chips beyond Nvidia’s dominant processors, signaling a diversification in the AI hardware market. As AI adoption accelerates across industries, the race to power the next generation of data centers and applications will only intensify.

With its trillion-dollar valuation, Broadcom has firmly positioned itself as a key player in this transformative era of AI.