Elon Musk’s six-year streak of selling more electric cars in the US than every other automaker combined may be coming to an end this month. Tesla Inc. is on the verge of losing a key bragging right it’s held for the past six years: outselling all EV competitors in the US combined.

Current Sales Data and Trends

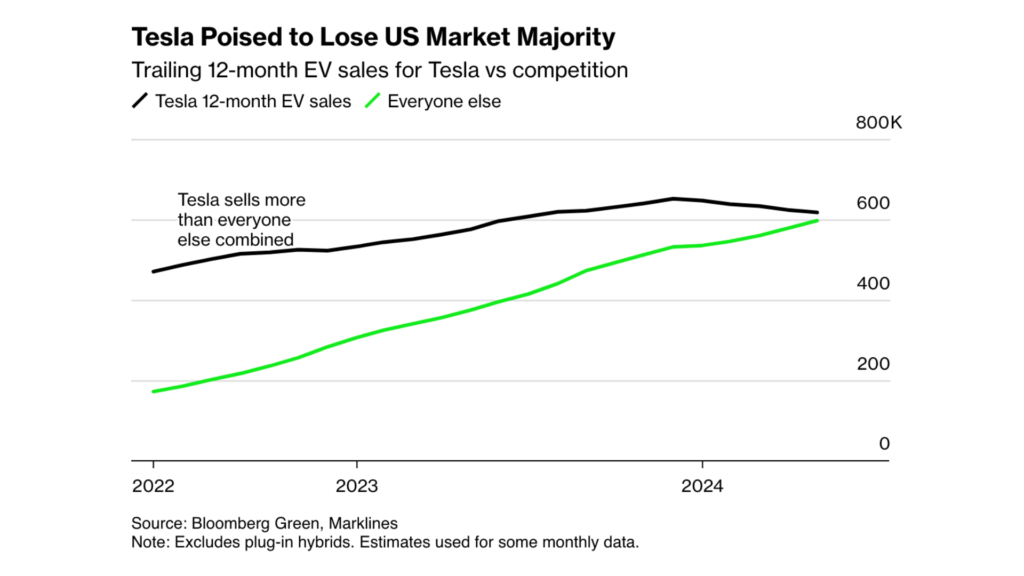

In the 12 months through May, Tesla sold approximately 618,000 electric cars in the US, compared with about 597,000 fully electric vehicles sold by other manufacturers, according to the latest figures from Marklines, a provider of monthly auto industry sales data. Next week, carmakers are slated to report second-quarter sales, which will include popular new models from General Motors Co., Hyundai Motor Co., and its affiliated Kia Corp.

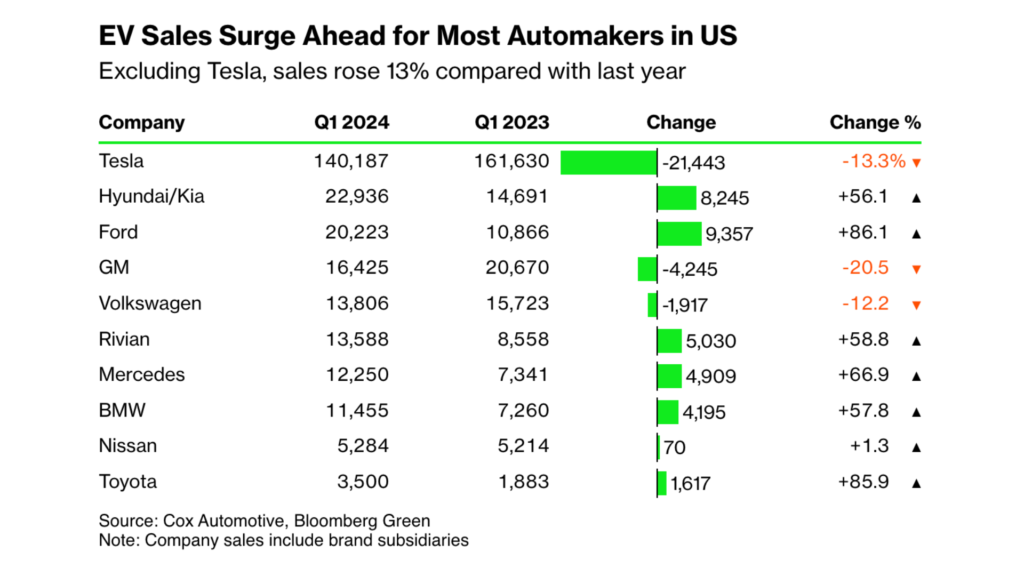

Tesla has been the top-selling EV maker in the US since its Model S luxury sedan overtook the Nissan Leaf in 2015, and it has sold more EVs than the rest of the industry combined since the Model 3 took off in 2018. However, traditional automakers have been steadily closing the gap. In the first quarter of this year, Tesla’s sales dropped 13% year-over-year, while sales rose at a scorching pace for six of the 10 biggest EV makers, with increases ranging from 56% at Hyundai/Kia to 86% at Ford. This trend continued in April and May.

Competitive Landscape and Challenges

Increased Competition

The increase in competition is one of the primary reasons Tesla might lose its market majority. Stephanie Valdez-Streaty, director of industry insights at Cox Automotive, notes that the market is now flooded with new models from various automakers, while Tesla relies heavily on just two vehicles for 95% of its sales. “Tesla just has a lot more competition now,” Valdez-Streaty said. “Elon really moved the industry forward with electrification, but he’s trying to compete against other brands with new models out — and Tesla doesn’t have any new models.”

Sales Reporting and Market Dynamics

Unlike other carmakers, Tesla only reports sales quarterly and doesn’t break out global sales by region, making it difficult to pinpoint exactly when the balance will tip. Analysts estimate the company’s monthly US deliveries using state registration data and international sales reports. However, what is apparent is that Chief Executive Officer Elon Musk’s polarizing politics are also chipping away at Tesla’s dominance.

Tesla’s Current Market Position

To be clear, Tesla remains the biggest EV-maker in the US by a significant margin. Over the past 12 months, it sold more than five times as many electric cars in the country as its closest rival, Hyundai/Kia. Tesla also makes the best-selling car in the world, the Model Y, and sells more fully electric vehicles globally than anyone else. Despite a major slump in the stock price, Tesla remains the world’s most valuable car company, worth around $575 billion.

Long-Term Outlook

Market Perception and Valuation

Tesla’s long-term valuation may shift if investors begin to see it as more than just an auto company stuck in an increasingly competitive market. Morgan Stanley analyst Adam Jonas suggests that Tesla might eventually be valued like other tech giants that moved beyond their initial products. “The car is to Tesla what the video game chip is to Nvidia. The car is to Tesla what selling books is to Amazon,” Jonas said. However, for now, the car business generates more than 90% of Tesla’s revenue.

Future Aspirations

Musk has indicated that Tesla’s consumer automotive business will eventually be dwarfed by its clean-energy division, Cybercab taxi service, and humanoid robots. While this suggests a more diversified future, it remains to be seen if Tesla can retain its market majority in EVs as it faces increased competition.

Conclusion

Tesla’s dominance in the US EV market is being challenged by a surge of new models from traditional automakers. Although Tesla remains the largest EV maker by a significant margin, its market majority is at risk. The company’s future success may hinge on its ability to innovate and expand beyond its current automotive offerings, ensuring it remains a leader in the broader tech and energy sectors.